Building Rehabilitation Support

Uptown Marion Main Street works to encourage improvement of the District’s physical appearance. In partnership with building owners, local government and a variety of local and state design experts, this Uptown focuses on projects in the following areas:

- Design Guidelines Oversight

- Prioritizing Public Improvements

- Building Condition Analysis

- Historic Preservation

- Design Assistance

- Development & Oversight of Local Preservation Ordinances

- Design Education & Awareness

- District Beautification

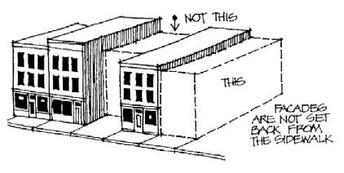

Design GuidelinesUptown Marion District design guidelines were developed to aid future development within the District by identifying desirable aesthetic qualities. These guidelines provide consistency and avoid arbitrary design, thereby giving the tools and advice needed to integrate new construction and remodeling into the surrounding community. Design guidelines introduce the Uptown Marion District community to the future, while maintaining its rich heritage.

Uptown also references the State Downtown Design Guidelines for preservation practices and new construction best practices. |

Financial Resources

State Challenge Grant

2024 Application: https://forms.gle/XoSbCgAkkW1LC11Y9

OVERVIEW:

A state appropriation was made to the Iowa Economic Development Authority (IEDA) for the Main Street Program to assist participating cities improve the physical and economic health of their designated Main Street districts. This state appropriation will allow Main Street Iowa to offer matching Challenge Grants to participating communities for vertical infrastructure projects.

A maximum of $1,000,000 in funds will be awarded to eligible applicants for bricks and mortar projects within designated Main Street districts. Each program may receive a single award from this funding round. Only one application per program is allowed.

Main Street Iowa staff will review all applications for eligibility, project impact in designated Main Street district, design appropriateness, innovation and utilization of the Iowa Green Streets Criteria. Successful applicants will be notified in writing of the grant awards. All awarded projects must agree to provide Main Street Iowa with appropriate budgetary information and expenditures.

ELIGIBILITY:

Main Street Iowa communities with current contracts who are meeting all contractual obligations including National Main Street Accreditation once within the past three years will be considered eligible for the Main Street Grant funds. Eligible projects must be within the designated Main Street district. Only the Main Street organization in participating communities may submit applications on behalf of local projects, properties and businesses. Awards will be made to the applicant Main Street organization, hereafter referred to as the Grantee, for disbursements to locally designated grant beneficiaries. GRANT AMOUNTS: Maximum awards for this grant round will be $100,000. Minimum grants will be no less than $25,000. No program shall receive more than one award per application round.

APPLICATION DEADLINE:

Local Pre-Application Opens in July.

Uptown is looking for projects with the highest likelihood of being awarded grant funds at the state level. Interested parties should complete the online pre-application no later than noon Monday August 5th, 2024. The project selected by the Uptown Advisors will be notified Thursday August 8th, 2024. Uptown Staff will then work with the selected nominee to submit a full proposal and application to the state.

GRANT CRITERIA:State Program Details Video: https://www.youtube.com/watch?v=D_jPekPtJpQ

Grantee must show community support evidenced by the local contributing effort. Grantee or the grant beneficiary(s) must invest at a minimum a dollar for dollar cash match and must supply requested financial information to show that the match requirement is being satisfied. Grantee and all Grant Beneficiaries agree, to the best of their ability, to complete designated projects within 24 months of award notification or show just cause for the delay. Main Street Iowa communities in good standing with the program and in compliance with all contractual requirements from previously awarded funds if any, may apply on behalf of a property or project within the designated district. Only one submission per program, per round will be permitted.

ELIGIBLE PROJECTS:

Rehabilitation and/or restoration of privately held properties within the designated Main Street district. This can include, but is not limited to:

Multiple properties connected by a common need or issue. Multiple property projects might include but are not limited to: the removal of inappropriate slipcovers/siding materials; façade restoration for several buildings; activation of a series of highly visible rear entries; or installation of an elevator and common hallway linking several buildings to support upper story development. Programs considering a Multiple Properties application are strongly encouraged to discuss the project with Main Street Iowa Staff before submission.

EXPENDITURES/MATCH:

AWARD ANNOUNCEMENTS:

CONTACT INFORMATION:

Jill Ackerman - Marion Chamber

jill@marioncc.org

OVERVIEW:

A state appropriation was made to the Iowa Economic Development Authority (IEDA) for the Main Street Program to assist participating cities improve the physical and economic health of their designated Main Street districts. This state appropriation will allow Main Street Iowa to offer matching Challenge Grants to participating communities for vertical infrastructure projects.

A maximum of $1,000,000 in funds will be awarded to eligible applicants for bricks and mortar projects within designated Main Street districts. Each program may receive a single award from this funding round. Only one application per program is allowed.

Main Street Iowa staff will review all applications for eligibility, project impact in designated Main Street district, design appropriateness, innovation and utilization of the Iowa Green Streets Criteria. Successful applicants will be notified in writing of the grant awards. All awarded projects must agree to provide Main Street Iowa with appropriate budgetary information and expenditures.

ELIGIBILITY:

Main Street Iowa communities with current contracts who are meeting all contractual obligations including National Main Street Accreditation once within the past three years will be considered eligible for the Main Street Grant funds. Eligible projects must be within the designated Main Street district. Only the Main Street organization in participating communities may submit applications on behalf of local projects, properties and businesses. Awards will be made to the applicant Main Street organization, hereafter referred to as the Grantee, for disbursements to locally designated grant beneficiaries. GRANT AMOUNTS: Maximum awards for this grant round will be $100,000. Minimum grants will be no less than $25,000. No program shall receive more than one award per application round.

APPLICATION DEADLINE:

Local Pre-Application Opens in July.

Uptown is looking for projects with the highest likelihood of being awarded grant funds at the state level. Interested parties should complete the online pre-application no later than noon Monday August 5th, 2024. The project selected by the Uptown Advisors will be notified Thursday August 8th, 2024. Uptown Staff will then work with the selected nominee to submit a full proposal and application to the state.

GRANT CRITERIA:State Program Details Video: https://www.youtube.com/watch?v=D_jPekPtJpQ

Grantee must show community support evidenced by the local contributing effort. Grantee or the grant beneficiary(s) must invest at a minimum a dollar for dollar cash match and must supply requested financial information to show that the match requirement is being satisfied. Grantee and all Grant Beneficiaries agree, to the best of their ability, to complete designated projects within 24 months of award notification or show just cause for the delay. Main Street Iowa communities in good standing with the program and in compliance with all contractual requirements from previously awarded funds if any, may apply on behalf of a property or project within the designated district. Only one submission per program, per round will be permitted.

ELIGIBLE PROJECTS:

Rehabilitation and/or restoration of privately held properties within the designated Main Street district. This can include, but is not limited to:

- Exterior rehabilitation (front, rear and side facades)

- Interior rehabilitation (first floor commercial and upper story housing)

- Structural repairs and building system improvements

- Single specific phase of a large rehab. The project must have a specific defined focus and clearly identified scope of work, with commitment to future phases demonstrated.

Multiple properties connected by a common need or issue. Multiple property projects might include but are not limited to: the removal of inappropriate slipcovers/siding materials; façade restoration for several buildings; activation of a series of highly visible rear entries; or installation of an elevator and common hallway linking several buildings to support upper story development. Programs considering a Multiple Properties application are strongly encouraged to discuss the project with Main Street Iowa Staff before submission.

EXPENDITURES/MATCH:

- No previous expenditures of any kind will be considered as suitable cash match for a project. This statement applies to both new applicants and additional submissions for phased projects.

- A dollar for dollar (1:1) CASH match is required for ALL projects. In kind contributions, while important, cannot be used to meet match requirements for any project.

- The match requirement may include necessary project “soft” costs for professional service i.e. architectural or engineering directly related to the project/property.

- EACH structure included as part of a MULTIPLE PROPERTIES application must meet the individual minimum project investment threshold ($25,000 grant/$50,000 minimum total investment.) For example this applies to multiple façade improvements, upper floor rehabs or energy efficiency/sustainability improvements. It does not apply if the project is a large, single investment that impacts a number of properties like a common elevator or fire suppression system.

AWARD ANNOUNCEMENTS:

- 2014 Challenge Grant Recipient: $75,000 Memorial Hall BLDG/Uptown Snug

- 2015 Challenge Grant Recipient: $55,000 Cobban-Hervey BLDG/Anderson Bogert/Urban Pie

- 2016 Challenge Grant Recipient: $75,000 Kuba-Kurtz BLDG/ Brick Alley Pub & Sports Bar

- 2017 Challenge Grant Recipient: $75,000 Park Place BLDG/ Coldwell

- 2019 Challenge Grant Recipient: $75,000 Owen Building

- 2020 Challenge Grant Recipient: $75,000 Monuments Building/Frydae

- 2022 Challenge Grant Recipient: $100,000 Draper Building

- 2023 Challenge Grant Recipient: $100,000 Coenen Building / Marion Chocolate Shop

CONTACT INFORMATION:

Jill Ackerman - Marion Chamber

jill@marioncc.org

Tax Increment Financing

|

TAX INCREMENT FINANCING

Tax Increment Financing (TIF) is a common method where City councils or boards of supervisors may use the property taxes resulting from the increase in taxable valuation caused by the construction or substantial rehabilitation of commercial facilities to provide economic development incentives within the district. Tax Increment Financing is the most versatile and common form of financial assistance that is available to companies looking to expand or build a facility in our community. TIF is available to businesses that both qualify for the program and generate new property taxes through either new construction or substantial renovation of their current facility. New property taxes created through capital investment are rebated back to your company over an agreed upon period of time. City of Marion Tax Increment Financing Policy TO APPLY CONTACT: Mark Seckman, President MEDCO – Marion Economic Development Corp [email protected] | (319) 743-4624 |

|

Historic Tax Credits

STATE HISTORIC TAX CREDITS

The State Historic Preservation Tax Credit Program provides a state income tax credit for the sensitive, substantial rehabilitation of historic buildings. It ensures character-defining features and spaces of buildings are retained and helps revitalize surrounding neighborhoods. The program provides an income tax credit of up to 25% of qualified rehabilitation expenditures (QREs).

UPCOMING REGISTRATION ROUND:

The Iowa Economic Development Authority (IEDA) administers the program in consultation with SHPO. IEDA accepts funding applications, referred to as a registration round during set periods during the year as listed on their website.

APPLICATION PROCESS:

The State of Iowa historic tax credit program consists of six mandatory steps:

REVIEW PROCESS:

The State Historic Preservation Office of Iowa (SHPO) has a 90-day review period from the date a complete application for each Part is received. However, the 90-day period is not binding. For incomplete applications, the review will be placed on hold until all information is provided. At the time all requested information is received, the 90-day review period will restart. The application may be denied if any requested information is not provided. Parts 2 and 3 reviews will not start until payment of the review fee has been received.

Additionally, if the completed rehabilitation work does not meet The Secretary of the Interior’s Standards for Rehabilitation as determined by the State Historic Preservation Office, or if the applicant does not otherwise comply with the terms of the agreement, law, or regulations, tax credits will not be awarded. Awarded credits may also be subject to recapture as described in Iowa Code.

More Information

The State Historic Preservation Tax Credit Program provides a state income tax credit for the sensitive, substantial rehabilitation of historic buildings. It ensures character-defining features and spaces of buildings are retained and helps revitalize surrounding neighborhoods. The program provides an income tax credit of up to 25% of qualified rehabilitation expenditures (QREs).

UPCOMING REGISTRATION ROUND:

The Iowa Economic Development Authority (IEDA) administers the program in consultation with SHPO. IEDA accepts funding applications, referred to as a registration round during set periods during the year as listed on their website.

APPLICATION PROCESS:

The State of Iowa historic tax credit program consists of six mandatory steps:

- Part 1 - Evaluates the building’s integrity and significance and project eligibility (submit in ESHPO).

- Part 1.5 Pre-Application Meeting – Offers feedback that will enable you to prepare better applications for the Part 2 submittal (schedule in online scheduler).

- Part 2 - Evaluates that the proposed rehabilitation work meets The Secretary of the Interior’s Standards for Rehabilitation (submit in ESHPO).

- Part 2B Registration – Evaluates submitted materials for the project’s planning and financial readiness (submit in iowagrants.gov).

- Agreement - Establishes the terms and conditions that must be met to receive the tax credit and establishes the estimated amount of the tax credit.

- Part 3 - Evaluates that the completed work has met The Secretary of the Interior’s Standards for Rehabilitation and that all other requirements of the agreement, laws, and regulations have been met (submit in iowagrants.gov).

REVIEW PROCESS:

The State Historic Preservation Office of Iowa (SHPO) has a 90-day review period from the date a complete application for each Part is received. However, the 90-day period is not binding. For incomplete applications, the review will be placed on hold until all information is provided. At the time all requested information is received, the 90-day review period will restart. The application may be denied if any requested information is not provided. Parts 2 and 3 reviews will not start until payment of the review fee has been received.

Additionally, if the completed rehabilitation work does not meet The Secretary of the Interior’s Standards for Rehabilitation as determined by the State Historic Preservation Office, or if the applicant does not otherwise comply with the terms of the agreement, law, or regulations, tax credits will not be awarded. Awarded credits may also be subject to recapture as described in Iowa Code.

More Information

IEDA resources

COMMUNITY DEVELOPMENT BLOCK GRANT (CDBG)

The Iowa Economic Development Authority (IEDA) administers the federal Community Development Block Grant (CDBG) program in all of Iowa’s incorporated cities and counties, except those designated as HUD entitlement areas. Authorized under the Housing and Community Development Act, the main goal of the program is to “develop viable communities by providing decent housing and suitable living environments and expanding economic opportunities, principally for persons of low and moderate incomes.” All projects must meet the National Objectives as defined by HUD.

WORKFORCE HOUSING TAX CREDITS

This program provides tax benefits to developers to provide housing in Iowa communities, focusing especially on those projects using abandoned, empty or dilapidated properties.

More Information

REDEVELOPMENT TAX CREDITS FOR BROWNFIELD & GRAYFIELD

Developers in Iowa can receive tax credits for redeveloping properties known as brownfield and grayfield sites. Additional tax credits are available for projects that meet or exceed sustainable design standards as defined by state law.

Brownfield sites are abandoned, idled or underutilized industrial or commercial properties where real or perceived environmental contamination prevents productive expansion or redevelopment. Examples of brownfield sites include former gas stations, dry cleaners and other commercial operations that may have utilized products or materials potentially hazardous to the environment.

Grayfield sites are abandoned public buildings, industrial or commercial properties that are vacant, blighted, obsolete or otherwise underutilized. A grayfield has been developed and has infrastructure in place, but the property's current use is outdated or prevents a better or more efficient use of the property.

More Information

The Iowa Economic Development Authority (IEDA) administers the federal Community Development Block Grant (CDBG) program in all of Iowa’s incorporated cities and counties, except those designated as HUD entitlement areas. Authorized under the Housing and Community Development Act, the main goal of the program is to “develop viable communities by providing decent housing and suitable living environments and expanding economic opportunities, principally for persons of low and moderate incomes.” All projects must meet the National Objectives as defined by HUD.

- Downtown Revitalization Fund

- Housing - Upper Story Conversions

WORKFORCE HOUSING TAX CREDITS

This program provides tax benefits to developers to provide housing in Iowa communities, focusing especially on those projects using abandoned, empty or dilapidated properties.

More Information

REDEVELOPMENT TAX CREDITS FOR BROWNFIELD & GRAYFIELD

Developers in Iowa can receive tax credits for redeveloping properties known as brownfield and grayfield sites. Additional tax credits are available for projects that meet or exceed sustainable design standards as defined by state law.

Brownfield sites are abandoned, idled or underutilized industrial or commercial properties where real or perceived environmental contamination prevents productive expansion or redevelopment. Examples of brownfield sites include former gas stations, dry cleaners and other commercial operations that may have utilized products or materials potentially hazardous to the environment.

Grayfield sites are abandoned public buildings, industrial or commercial properties that are vacant, blighted, obsolete or otherwise underutilized. A grayfield has been developed and has infrastructure in place, but the property's current use is outdated or prevents a better or more efficient use of the property.

More Information